by Michelle Lopez – Senior Oracle EPM Consultant

Efficiency is the holy grail of productivity but finding that balance between working less and achieving more can be elusive. Often, the fear lingers that streamlining processes might sacrifice quality or overlook crucial details. However, within the realm of account reconciliation, striking this balance is not only feasible but highly advantageous.

Account reconciliations serve as the bedrock of financial oversight, offering insights into General Ledger activities critical for accurate analysis. Yet, drowning in excessive information can stifle productivity. To combat this, organizations establish thresholds for materiality, assign risk ratings to accounts, and set review frequencies to ensure focused efforts. Enter the Oracle Account Reconciliation Cloud Service (Oracle ARCS), a tool designed to harness these criteria for efficient and meaningful analysis.

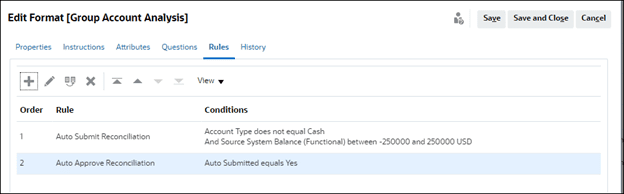

A pivotal feature within ARCS lies in its Rules functionality. Customizable to align with predefined criteria, Rules empower auto-submission capabilities, automating reconciliations with precision. For instance, if an organization mandates monthly reconciliation for accounts tagged with a “High” risk rating, irrespective of balance, a tailored Rule can enforce this requirement across all formats seamlessly. Similarly, setting balance thresholds—such as the example of a $250k materiality level—empowers auto-submission for eligible accounts.

These instances merely scratch the surface of how Rules within ARCS can revolutionize reconciliation processes. By leveraging Rules judiciously, organizations not only maximize efficiency but also uphold the integrity of financial oversight, striking a harmonious balance between effort and outcome.

The following examples illustrate how Oracle ARCS can automate the approval of reconciliations based on predefined rules, improving operational efficiency and compliance with reconciliation policies.

Rule Name: Auto-Approval for Small Balance Non-Cash Reconciliations

Description: This rule automates the approval process for reconciliations in the ARCS system that meet specific criteria regarding balance and type.

Trigger Conditions:

- Reconciliation Type: Non-Cash

- Balance Range: Between -250,000 and 250,000

Action Taken:

Upon completion of reconciliation, if the balance falls within the specified range and the type is non-cash, the reconciliation will be automatically submitted for approval.

After submission, the reconciliation will undergo an automated approval process without requiring manual intervention.

Benefits:

- Enhances efficiency by reducing manual review and approval time.

- Ensures consistent application of approval criteria based on predefined rules.

- Facilitates timely completion of reconciliations within acceptable balance thresholds.

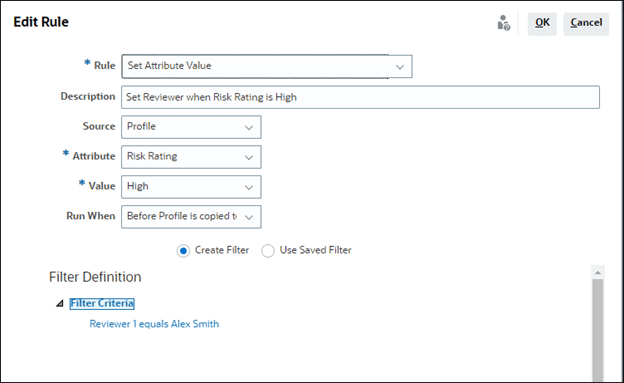

Rule Name: Approval Workflow Based on Risk Profile

Description: This rule assigns different approval workflows based on the risk profile of the reconciliation.

Trigger Conditions:

- Risk Category: High, Medium, Low (based on predefined criteria)

- Reconciliation Type: Any

Action Taken:

Routes reconciliations to appropriate reviewers based on their risk category for approval.

Benefits:

- Tailors approval processes to the level of risk associated with each reconciliation.

- Improves oversight and control over critical reconciliations.

Ready to Optimize Your Account Reconciliation Process with Oracle ARCS?

Unlock the full potential of Oracle ARCS to enhance your financial efficiency. Start optimizing your account reconciliations today and experience the transformative power of automation and precision. Contact us or the author to learn and schedule a demo!

Michelle Lopez – Senior Oracle EPM Consultant